By April 1st, most workers will see a reduction in taxes withheld due to the $787 billion economic stimulus package, but unfortunately, the extra $65 a month for a family of four isn’t going to go very far.[social_buttons]

It’s certainly not going to make the payment on a new car or house, but tax breaks on those purchases are also being touted as an important part of the stimulus package. And it’s not going to keep your mortgage payment current.

Other tax breaks, for parents of college students, might help those who are eligible and willing to go to school, but based on the number of underemployed college graduates we have in the US right now, I find it hard to believe that these credits are going to have a lasting impact on most families or on the economy. Besides, you still have to come up with tuition, books, room and board for those students. How is that going to help, unless you sell text books or rent apartments to students?

Perhaps the most effective part of the stimulus package tax credits for families will be for homeowners who add energy-efficient windows, furnaces, water heaters, and air conditioners. They can get a tax credit to cover 30 percent of the costs incurred, up to a total of $1,500. Even with this credit, you have to come up with the other 70%, and you do have to own the house. Not much help for the renters…

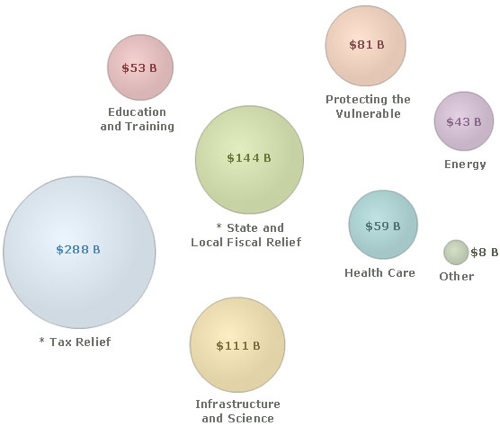

The Stimulus Package numbers, straight from Recovery.gov:

$288 billion … Tax Relief*

$144 billion … State and Local Fiscal Relief*

$111 billion … Infrastructure and science

$81 billion … Protecting the Vulnerable

$59 billion … Health Care

$53 billion … Education and Training

$43 billion … Energy

$8 billion … Other[* Where “Tax Relief” includes $15 billion for Infrastructure and Science, $61 billion for Protecting the Vulnerable, $25 billion for Education and Training and $22 billion for Energy, so total funds are $126 billion for Infrastructure and Science, $142 billion for Protecting the Vulnerable, $78 billion for Education and Training, and $65 billion for Energy. *State and Local Fiscal Relief – Prevents state and local cuts to health and education programs and state and local tax increases.]

For those families with children, the $1,000 child tax credit would apply to more low-income families that don’t earn enough to pay income taxes, and low-income families with three or more children will be eligible for an expanded Earned Income Tax Credit.

My personal feeling on this is that the stimulus package will benefit private enterprise more than private citizen, and if you’re lucky enough to replace your current or lost job with one working for the infrastructure projects, then it may benefit you. I certainly don’t think that building more roads is going to help (unless you’re a contractor), and as far as the new car tax credit goes? You gotta be kidding me.

As for me? I can benefit more by parking my car and not driving it, by making food instead of eating out, and in general, just saving my money instead of spending it.

So what I really want to know from you is:

Where are you going to spend your extra $65 a month?

Image: Recovery.org under Creative Commons

Yeah, why bother, eh?

Since I am fortunate enough not to need the increase, I will use it to help those that do. I will use it to increase my monthly donation to the local charitable food pantry.

Well, since I’m a single person, I won’t even be receiving that much per month so it will make NO difference to me. LOL, it will probably shoot me up an income tax bracket and cost me money in the long run. I agree, don’t spend your money-that’s the only way to have more of it.

I think I’m going to need to spend it on mental health care since this whole thing makes me so incredibly CRAZY!

i am self employed and out of work , soi what do they send me 13 dollars a week. i think the taxpayers should get thousand’s of dollars each for stimulus for look our goverment and wall streel riped us off for a lot more than 13 dollars a week , it is an insult , treating us like dummies and giving us a allowance.

and where dose all the toll bridge money and toll road money and gas tax money go that is suppposed to be used to keep up our roada and bridges

very upset being treated like this . obama is a smart man and anyone who isnt as smart must be stupid to him

13 dollars a week is such a joke

The current deficit is 54 trillion dollars. We had a deficit in all the years that Bill Clinton was in office. We have had a deficit since WW2.

We were broke back then. It took a war to end the Great Depression.

We had full employment finally only because if you weren’t working an Industry supporting the nation or the war effort, you were getting shot at. So unless we have Armageddon this crisis is going to be with us forever. We have had a deficit since before most of you were born.

We have Never had a budget surplus. Never. In the Clinton years, the final two, it was announced there was a budget surplus only so the House Democrats could spend it. They were not counting all the money they borrowed from Social Security, or for that matter to fight Hitler.

We will never pay off all we owe. Anyone who tells you different is lying.

All you have to do is read their lips.

We are now financialy screwed. Our kids are really screwed. And our grandchildren are absolutely F*&$ed. I mean geez, our 4th biggest expenditure in this country is the intrest on our debt. Not the entire debt mind you, just the interest. The national debt — the sum of all annual budget deficits — stands at $10.7 trillion. Or about $36,000 for every man, woman and child in the U.S. and yet only our politicians are moronic enough to keep borrowing. The real economic killer is the lack of jobs and this bill provides almost nothing but temporary jobs instead of trying to get all of those permenant jobs back that went overseas.

And let’s not forget that it was Clinton who REQUIRED banks to make sub prime loans to those who could not afford it which is the #1 reason the housing market collapsed. And it was Clinton who championed free trade which has done nothing but export our manufacturing jobs overseas. The Democrats trashed the economy for some lousy short term gains.

BTW Chris, as you can see I’m not an Obama fan either but you need to get your facts straight. The deficit was only $10.7 trillion (ONLY being a relative word) and the deficit didn’t really begin to get out of control until the Reagan years. Even then it was still managable but only in recent times has it spun out of control.

I am going to use it to help offset my state tax increases.

As a single guy, if the feds save me $30/month, my California tax increases are lessened by half.

This is just what the doctor ordered! Change, Yeah that’s it A real change we can believe in! The only thing funnier is that they lead the dumb, stupid and deaf right to the slaughter house. Yea The Dems sucker us right in. $13.00 a week. Hey stupid Don’t spend it all in one place!

G gettem!

“I am going to use it to help offset my state tax increases.”

Ditto. That is assuming that we even get the tax break in the first place rather than hit with the AMT again like we did for ’08.

Just remember that socialism is great until you run out of people to pay for it! As long as Obama has everyone believing they can get something for nothing the U.S. is doomed. The change we can believe in is the fact that our economy is on the verge of collapse and our government would have us believe that we can borrow and spend our way out of it. What a joke! So what happens when all of the countries we owe money to figure out we can’t pay them back?

Any money the federal government puts into our pockets will be more than offset by the cost of living increases which will include higher taxes on just about anything that can be taxed. New ways of taxing citizens are being pursued on a large scale now. Municipalities will increase the use of private enterprise photo-enforced speed and red light cameras to raise revenues. Licensing fees, insurance, etc. will cost more. It is important to pay attention to what has happened to the citizens of the United Kingdom, because the same eroding of are freedoms is being pushed for and is happening here in the U.S. Paul Turner

I can see that none of you are the vulnerable or the working poor — the ones will probably really appreciate another 60 or so dollars for food or medicine. I’m a single parent getting ready to borrow some money for my son to go to college (that might actually be there to be lent out now), so, I am in a boat where every little bit will help. And I’ve gotta say, its kind of … I don’t know, appalling maybe, to hear so many of you turning your noses up at the extra money in your checks. Kind of snobby. But so glad for all of you doing well enough to wave it off

Marie- I’m not turning up my nose at any decrease we might receive in our Federal tax bill. All I’m saying is that the increase in my state taxes is going to eat up the entire thing. Our annual car registration tax is going to double. There’s going to be a 1% increase in the sales tax. And our state income tax is increasing because the rate is going up and the dependent child credit is going to shrink by $200.

What the Feds giveth, the People’s Republic of California taketh away…

Well I guess that will help cover the increased sales tax we are getting, if I’m lucky it will cover all of the increased sales tax that I have to pay.

What am I going to do with my $65? Nothing. I’ll never even see it. I live in CA and they just raised sales taxes by 1% and state income taxes by 1/4% and doubled car registrations (what a coincidence, huh?). I figure with all the state increases, I’m looking at a negative $10-15 per month, even WITH the federal tax relief. The state even held up my tax refund

(2 months and counting) because poor management and political bickering has brought the state coffers to near bankruptsy. But if I DID get anything, I’d probably just give it to my elderly parents who are struggling in NY on Social Security that has not kept up with skyrocketing food and heating costs. If any of you CA legislaters are out there listening, come next election, you are SOOOO out of here.

If you did the research Chris you would see Between the years of 1993-1995(when Clinton was in office) there was a $90 billion shrink in the deficit! After that we actually had a nice 4 year run being in the positive numbers! So your comment that “we have been in a deficit since WW2” is incorrect. If you look at the data it wasn’t till after 9/11 that we had a deficit again. If you want to check out the website that had all the information copy and paste this site into your browser. Hope you find it interesting.

http://www.davemanuel.com/history-of-deficits-and-surpluses-in-the-united-states.php

but here is what the numbers look like for the surplus.

1998 69.2 Billion Dollar Surplus

1999 125.6 Billion Dollar Surplus

2000 236.4 Billion Dollar Surplus

2001 127.3 Billion Dollar Surplus

As for the crap were going through now….who knows what’s to come.